Double 11 or Singles’ Day has been the most important shopping festival in China for more than a decade. Recently, the booming two-digit year-on-year growth seems to be slowing down. In this article, we will analyze the following points:

- A brief introduction about Chinese eCommerce giant and Double 11

- Why is Tmall Double 11 sales growth slowing down?

- Is Tmall still a good option to sell in China?

- How should your brand react to the ever-changing Chinese digital ecosystem?

Want to get started on Tmall? WalktheChat is an official Tmall Partner for both Tmall Global, Tmall Classic, and offers synchronization services between Tmall and Shopify.

Chinese eCommerce giant Tmall and Double 11

The record-breaking sensational shopping festival

Tmall first initiated the Double 11 Single’s Day Shopping Festival in 2009. Over the years, it has evolved into a national shopping phenomenon that affects the global retail industry.

On November 11th, 2012, the one-day sales of Double 11 surpassed Cyber Monday in the United States. It has been officially the world’s largest Internet Shopping Festival. The battlefield of Double 11 further extends to December, which is named Double 12.

Tmall throws a nationwide festival with huge discounts, celebrity shows, evening galas, and endless live streaming sessions every year. Other players such as JD.com and Pinduoduo also try their best to create a heated shopping atmosphere.

Double 11 entered a new phase since 2020

In 2020, during the COVID-19 pandemic, Tmall announced that the Double 11 would have two sales windows. The first sales window will be November 1 to 3, and the second one will be on November 11th. For the first time, Tmall extended the official sales days from 24 hours to 4 full days, marking the start of a new era for Double 11 (this strategy was extended in 2021).

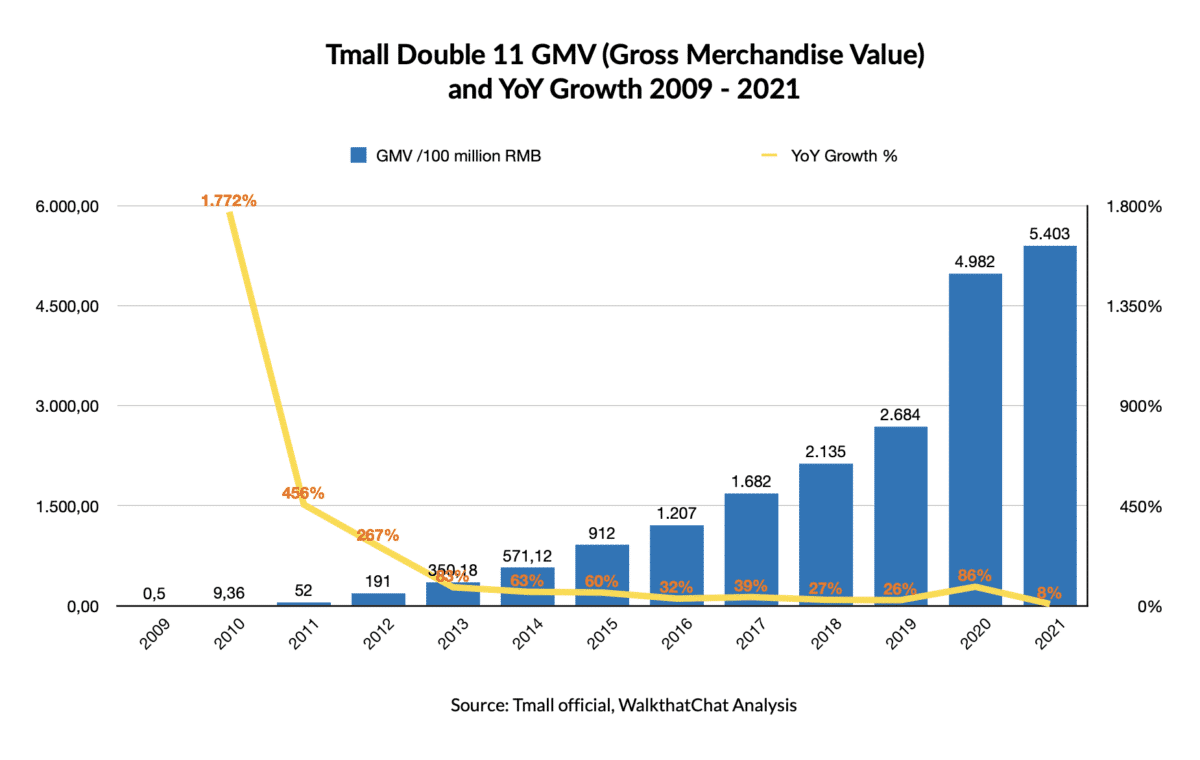

The idea of extending official sales days was to give consumers more days to consider and finalize their purchases. Double 11 again hit a historical high of 540.3 billion CNY (~84.5 billion USD) 290,000 brands participating in Tmall. However, several details should draw our attention here:

- The 86% YoY growth in 2020 looked promising, but we are comparing 4-day sales with 24 hours sales.

- In 2021, Tmall ended up obtaining only an 8% YoY growth. Attracting consumers’ attention by evening galas and entertainment has lost its appeal. After reaching this tremendous sales number, it is clear that the Double 11 shopping festival has slowed down in growth. It is also likely to stay a single-digit growth for a while.

- Consumers are used to comparing prices cross-platform. Tmall is still the number 1 eCommerce platform in the Chinese eCommerce ecosystem. However, it’s facing challenges from other platforms: JD.com is strong in consumer electronics and domestic appliances; PDD (Pinduoduo) is famous for offering low prices, although consumers also expect a lower quality from PDD merchants.

Why is the growth of Double 11 sales in China slowing down?

While Tmall sales growth decreased dramatically, Alibaba’s competitor JD.com registered a YoY growth of 28.6%, better than Tmall but slower than the 33% growth from 2019 to 2020. The Double 11 growth slow down is a common phenomenon among conventional eCommerce platforms. Let’s deep dive into the reasons why it is happening.

Consumer fatigue towards Double 11

The Double 11 has been around for more than a decade, and it was only a matter of time before consumers started to lose interest. The Chinese digital ecosystem went through tremendous progress over the years. Customers are familiar with digital innovations offered by platforms and brands, so they are not as excited by novelty as they used to be.

Longer sales window diluted the urgency to buy

In 2021, Double 11 started with pre-sale in late October, making it a long “battle” of 10 to 20 days. Many consumers already bought what they wanted in phase 1 and soon lost interest. Two sales windows mark the original date of this event – Nov. 11th – look weaker and softer than before.

Live-streamings sales attract users’ attention

Live streaming e-commerce brings consumers a more intuitive, vivid, and engaging shopping experience than static environments. It usually brings sound marketing effects and high conversion rates. As a result, it has become a new growth driver for the e-commerce industry. For example, during Double 11 2021, 39% of consumers bought during live streaming e-commerce, making it the second-largest sales channel.

Live streaming sale is no longer the exclusive weapon of eCommerce platforms such as Taobao/Tmall. Instead, social media such as Douyin, Kuaishou, WeChat, and Red also enabled live-streaming capacity, trying to capture users’ limited attention. Nowadays, Chinese people now enjoy a great variety of options to entertain themselves with live streamings, talk shows, etc., so that it’s harder for Tmall to create an even more engaging “festival” atmosphere as it used to.

For example, Chinese skincare brand Herborist delivered the most engaging live streaming sales during Double 11. In this session, live streamers and actors dressed up as characters from Chinese historical dramas. They leveraged the historical context to amuse the audience and strengthened Herborist’s positioning as a trustworthy Chinese brand. Moreover, they used the play’s plot to encourage consumers to purchase. Although not led by top live streamers, Herborist captured users’ attention and became a hot topic on Chinese social media.

Promotions all year round dilutes people’s purchasing power

There are several promotions across the year, with heavy discounts, and 11/11 stands out less than it used to. Top live streamers such as Austin Li and Viya can convert a random day into a sales festival. Although they are incredibly picky in selecting the brands to collaborate with, many big names still try hard to get exposed in their live stream in exchange for millions worth of transactions. Such revenue often comes with a cost: brands have to provide the lowest price in the market to get exposure. Even the first-tier international brands such as L’Oreal and Lancôme also have to offer the lowest price for a certain period.

Hundreds of live streamings offer promotions such as “buy 1 get 5” all year round, increasing consumers’ excitement threshold. As a result, Chinese consumers no longer buy for simply a “50% off” during Double 11.

Introspection on consumerism, rational and sustainable shopping

After reaching a tremendous number with decades of two-digit growth, the Chinese economy and market are calming down. Many consumers are getting more reflective and are making rational and logical shopping decisions. Chinese consumers are pursuing not only “what to buy” but also “for whom” and “sustainable shopping”. They tend to purchase after doing proper research of the brand and product. The importance of pre-sale research also led to the rise of the UGC (user-generated content) community and social commerce platforms such as Red / Xiaohongshu.

If you are interested in Red, click here to learn more about Red marketing and advertising.

Should your brand still consider Tmall to drive sales in China?

Tmall remains the number 1 eCommerce platform in China

Although there are concerns about the future of Double 11, Tmall is still the number 1 eCommerce marketplace in China. In terms of market share, in 2021 Q3, Tmall’s total turnover increased by 12.9% over the same period last year, occupying 64.2% of the market, ranking first. JD’s total transaction volume increased by 24.7% compared to the previous year and reached a market share of 28.5%, ranking second. Although JD.com is growing faster than Tmall, it is still not strong enough to challenge Tmall’s leading position.

Tmall and Taobao have the most qualified users ready to purchase

It’s common for Chinese consumers to compare prices across various eCommerce platforms and then decide where to buy, considering the price and services. However, among top retail eCommerce platforms, Taobao and Tmall still have the highest percentage of users who entered the payment page During Double 11. This number suggests that Taobao and Tmall probably offer better conversion strategies, promotional activities, or customer service to stand out from the competition.

Choose the best-fit eCommerce platform for your vertical

For foreign brands who want to enter China, Tmall is still the first option for you to reach millions of active shoppers. Especially for verticals such as fashion, luxury, skincare, beauty, mom&baby, etc, we still recommend you to sell on Tmall. Most consumers will get inspired on social platforms such as Red or WeChat, and then finalize the purchase on Tmall.

More questions about selling on Tmall?

If there are still unanswered questions about selling your product on Tmall or other social platforms, feel free to reach out to us for a customized approach.

Tmall advertising enables to drive traffic and sales

Another reason is that Tmall offers a variety of in-platform paid marketing and advertising tools. You can drive traffic to your store and boost sales by paid methods. Usually, you’ll need a Tmall Partner (TP) agency to manage the store and optimize your performance.

If you want to know more about Tmall advertising, we have a complete guide for you.

In case you are wondering how to select a Tmall Partner that works well? Please see this article for detailed information.

Tmall is embracing social responsibility and sustainability

Tmall quickly adapted to the new consumer trends and is leading the recent “sustainable shopping” trend. In response to people’s increasing pursuit for a healthy lifestyle, Tmall changed the official start time to 8 pm instead of midnight, so consumers won’t need to stay up late. Then, reacting to customer’s desire for life quality, Tmall changed its Double 11 slogan to “Expect a Better Life Together (美好生活,共同向往)”, showing its humanistic care for consumers.

In response to the government’s efforts for social equality and reduced carbon emissions, Tmall also encouraged sustainable shopping and inclusiveness instead of promoting pure discounts. “Green” Lifestyle, Eco-Friendly Consumption was the top priority for this Double 11. Tmall is taking action to promote “green” lifestyles this Double 11 by featuring a dedicated vertical to showcase energy-efficient and low-impact products. Tmall also issued RMB100 million worth of “green” vouchers to incentivize shopping decisions that contribute to an environmentally-friendly lifestyle.

How should your brand react to new consuming trends in the Chinese market?

The answer is: adapt to the Chinese market for short-term results but keep your brand value as a long-term vision.

Leverage new booming trends in China with Douyin and live streaming

In 2021, traditional eCommerce platforms are already saturated. New social platforms such as Douyin and shopping channels like live streaming are the only ones with significant growth During Double 11.

According to a customer survey covering 1000 buyers conducted by Kantar China, 18% of the consumers purchased on Douyin during Double 11, increasing by 5 points compared to last year (13%). Although the percentage is still low, Douyin is the only platform where we observe such a positive trend. The traditional eCommerce platforms such as Tmall, Taobao, and JD still occupy the first three positions in market penetration. However, the mentioned rate of these conventional platforms has dropped compared to the previous Double 11.

Live streaming sales also managed to capture users’ attention in the most competitive battle of Double 11. It has surpassed desktop and grown to become the 2nd largest shopping channel during Double 11. However, sales-driven live streaming almost always has to offer huge discounts and promotions. We recommend brands leverage live streaming to reach a short-term peak, but it is not a long-term strategy. As long as the top hosts continue offering heavy discounts in their live streams, live streams will still be linked to low prices.

*Mobile and other Apps means static interfaces, excluding live-streamings

*Live-streamings include all live streaming sales conducted by eCommerce platforms and social media, such as Taobao, Douyin, WeChat, etc…

Optimize your brand’s performance in China with localization

An increasing number of consumers are showing affection towards Chinese brands. Such a trend is called Guochao, literally meaning Chinese trend. For example, among the brands that entered the TOP20 list of cosmetics transactions on Tmall, domestic products accounted for half of them in the past three years. In 2020, Perfect Diary (完美日记) and Florasis (花西子) emerged as the success story of C-beauty. For the first time, the market share of these two local Chinese brands surpassed international brands.

Foreign brands are facing fierce competition from the local Chinese brands. Therefore, it is vital to offer an online shopping experience adapted to Chinese customers’ habits, including WeChat Pay or Alipay, customer service with instant replies, and others.

Foreign brands also have to pay attention to Chinese consumers’ patriotism and cultural preference. For example, the boycott against BCI (Better Cotton Initiative) has damaged people’s good feelings towards many big international names such as Nike, Zara, H&M, and negatively impacted the sales. As a result, H&M had to close down 20 offline stores in China, and Tmall banned the brand’s flagship store.

Brand value is the foundation

In 2021, the number 1 reason Chinese customers decide to purchase a brand or product during Double 11 is because “it’s the brand they have been buying”. The survey shows that 68% of consumers admitted that familiarity and trust in a brand play an essential role in purchasing decisions. This driver is getting increasingly important over the years (up 18 points compared to 2020).

In comparison, “brands that I always pay attention to but haven’t tried due to high price” (38%) and “products that I was recommended in other channels” (36%) are the 2nd and 3rd reasons that people decide to buy, but have decreased in importance compared to 2020.

Double 11, in the end, is a conversion-oriented shopping festival. It’s a test or a reflection of how well your brand is rooted in Chinese consumers’ minds. Chinese consumers are becoming increasingly self-aware and prudent. They will keep supporting the brands that can understand their needs, respond to their concerns and resonate with their values.

Therefore, brands should keep investing in image building, storytelling and stay strong in their positioning. It is also crucial to engage with followers and try to be on their top of mind. In a word, try to maintain healthy daily sales instead of relying too much on shopping festivals.

Conclusion

Chinese e-commerce giants created online shopping festivals such as Double 11 to generate booming sales through discounts. However, they were not created with brands in mind.

As consumers are becoming less sensitive to promotions, these massive shopping extravaganzas are losing traction. It is the right moment for companies to reclaim the value of brand-building through investment in thoughtful campaigns and daily engagement with followers and consumers.

Only brands that stay true to their value, close to consumers, and strong in their positioning will triumph in the most competitive sales seasons.