Earlier this year, Alibaba bought a 40% stake in PayTM, the largest mobile payment processor in India.

What’s Alibaba’s strategy? Why is India such a good “next step” for Alipay today? That’s what we’ll deep dive today.

When India got rid of cash

On the 8th of November, India’s prime minister Narendra Modi addressed the nation and announced a revolutionary measure: completely removing 500 ($7.5) and 1,000 rupee notes from circulation in India.

This was a game-changing move as:

- 86% of the cash was removed from the Indian economy

- 98% of transactions were depending on cash before the new policy

The population of India only had a few weeks to deposit their cash before it became invalid, causing gigantic lines across the country.

The measure was meant to help fight corruptions. It was meant to let the government money trickle down to the less wealthy Indians before being caught up by corrupt officials. This was also a way for the government to push India in the 21st century by forcing the population to rely more on banks and electronic payments.

But there was another winner from this move: Paytm

The explosion of Paytm

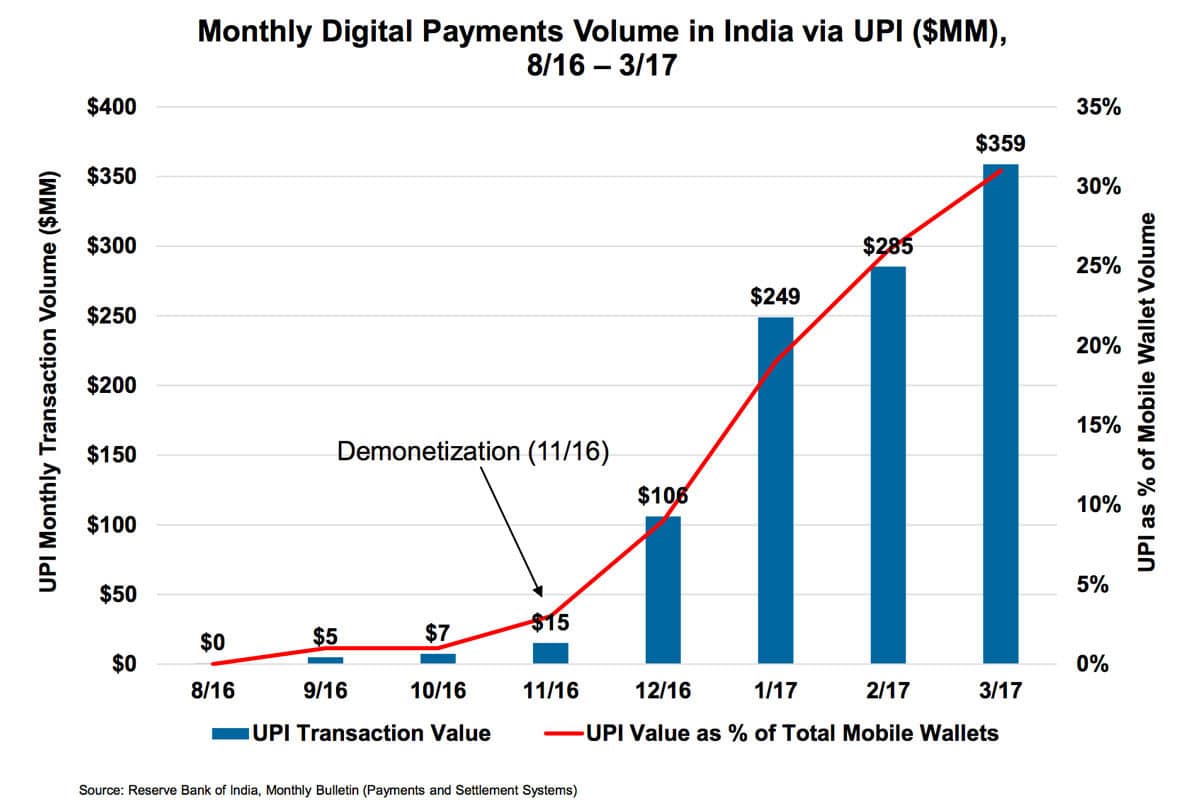

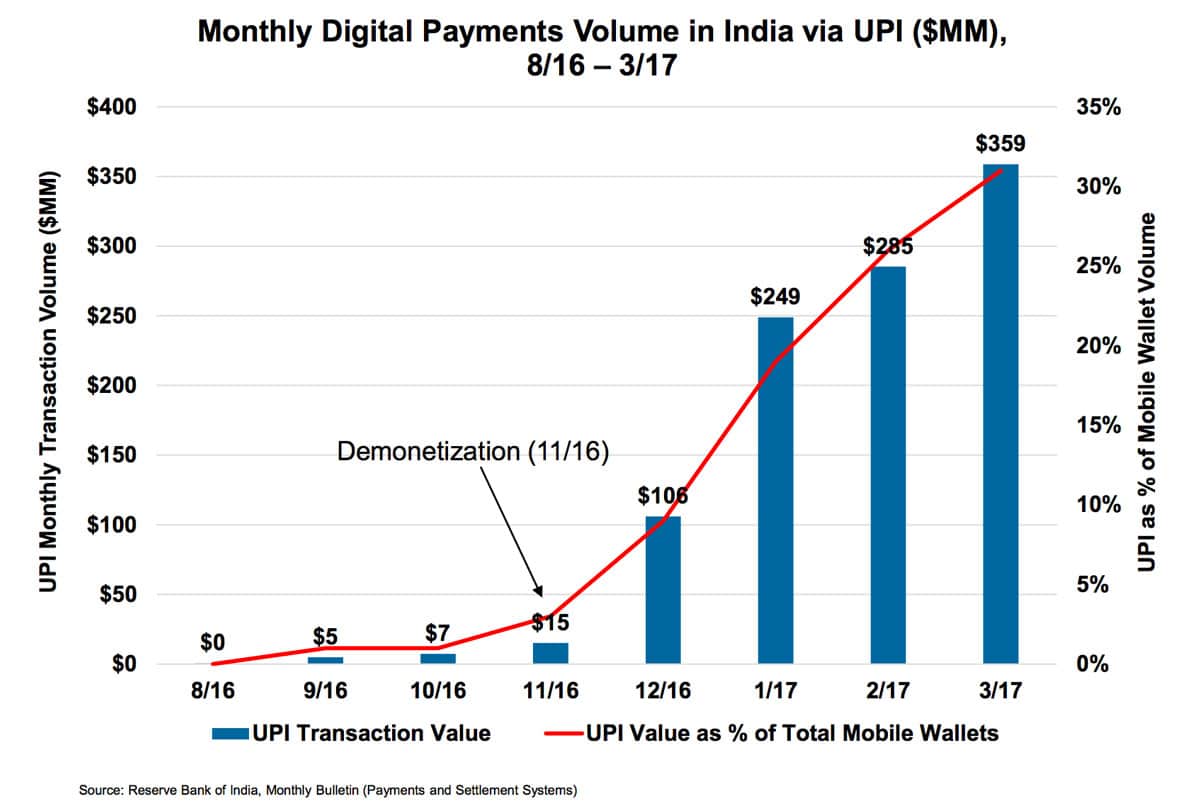

As soon as the removal of bank notes was announced (also called: “Demonetization”), the amount of digital transactions in India started exploding.

Before Modi’s announcement, few people had heard of Paytm. It has now become a household name with more than 200 million users in India, and an impressive growth:

- 5 million new users between November 8th and November 21st (that’s about 400,000 new users every day!)

- 7 million transactions per day, more than the combined average daily usage of India’s 24.5 million credit cards and 661.8 million debit cards (according to a Paytm press release)

- On November 18th, Paytm said it experienced 300% growth in transactions from offline stores in the previous 6 days

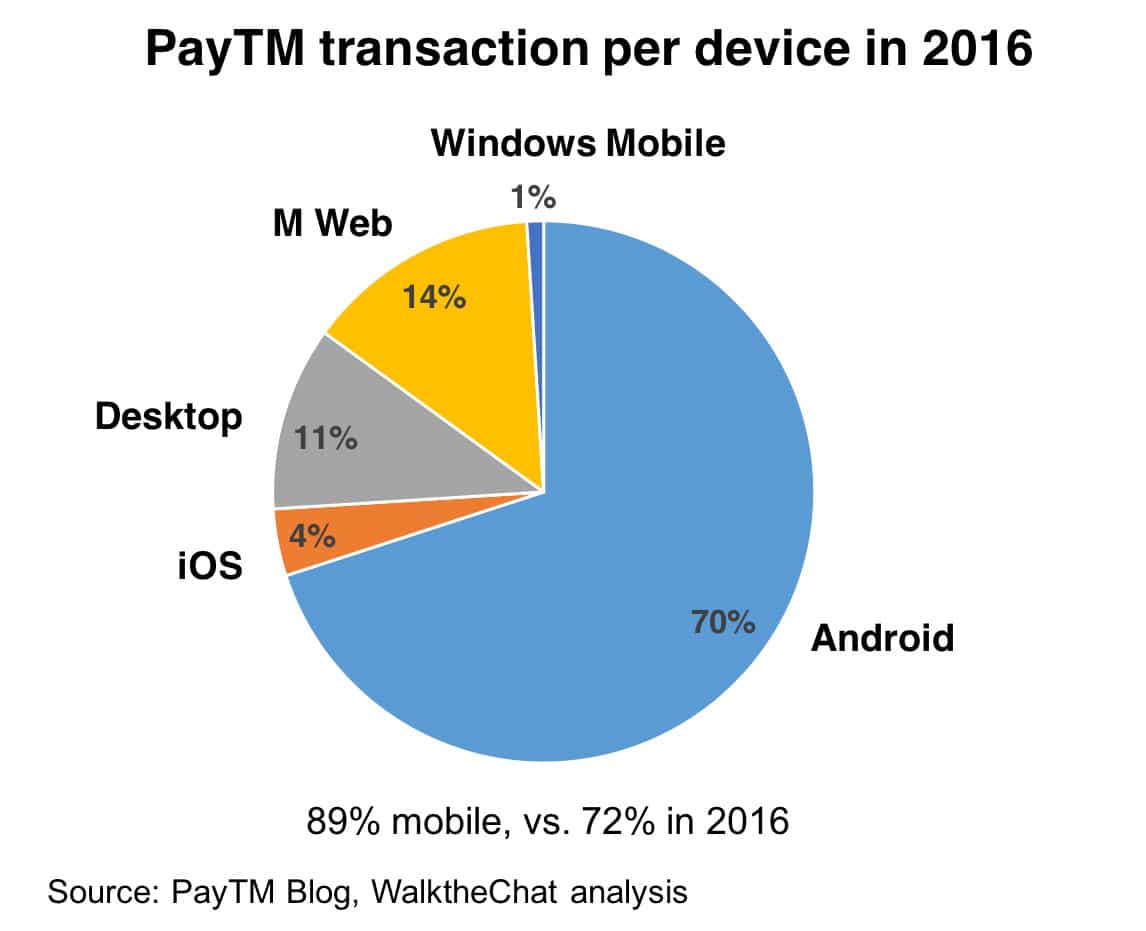

Just like China, India leapfrogged directly to mobile. Most of the Paytm transactions were coming from Android devices, very popular in India.

This made Paytm an extremely interesting investment target for Alibaba.

Alibaba’s bet on Paytm

Although some growth opportunities still exist for mobile payments in China, the situation in India leaves much more room for improvement:

According to the latest report released by the Bank of India in February 2017:

- India currently has 29.1 million credit cards and 840 million savings cards. In China in 2015, there were 432 million credit cards and 5.01 billion savings cards

- This means that the number of per capita credit cards and the number of per capita savings cards are respectively 1/15 and 1/6 of China’s 2015 levels

As we saw above, India is already a mobile-first country, and it is to be expected that mobile payment companies like Paytm will reap much of the upcoming growth.

More than money

Beyond money (and there was a lot of it: Ant Financial invested $680 million in the parent company of Paytm), Alibaba is also bringing its expertise to Paytm.

The Chinese E-commerce giants dispatched more than 100 engineers to Paytm in order to help them scale their business. Given the fact that India is facing similar challenges than China did a few year back, Alibaba’s experience might be just as valuable as the money it provided.

Conclusion

With this strategic investment, Alibaba is getting a strong foothold in the next frontier of mobile payments. By doing so, it is cutting the grass from under Tencent’s feet in the fight for international expansion.

It is likely Tencent will retaliate by investing in other countries’ mobile payments players, but it will have a hard time finding as good an investment as Paytm was in India.